Money Wizardry: Guide to Managing Your Personal Finance

#Finance

Personal Finance Is Hard if You Make It Hard

I've met many people who tried to build healthy personal finance management habits. Tried, only to give up and fail.

What did they typically have in common? They attempted to carefully track and categorize expenses, create a precise budget, and stick to it.

It's no surprise that this approach doesn’t work well:

- Managing finances can be boring, and any added complexity creates unnecessary friction.

- Unexpected circumstances often derail the budget, leading to frustration and failure.

It zooms in on every penny, drowning you in financial micromanagement. Effortless personal finance management, on the other hand, requires a zoom-out.

I've been using a different approach for years that not only works perfectly (for me) but it's also very efficient and requires no more than an hour per month.

Step 0: Deprecate Your Debts

Consumer Credits and Loans

That's the first thing you are to get rid of. They slowly poison your finances.

Forget.

Mortgage

Mortgage is questionable. There are too many things to consider, including interest rate, location, growth opportunities, inflation, rent prices, etc. It can be beneficial in general compared to the inevitable cost of rent.

Anyway, it's a leveraged investment with a debt to service and should be treated accordingly.

Credit Cards

Credit cards?

Forget.

Debit cards are your friends. Especially those with cashback and interest rates on leftovers. That's what helps your cash survive inflation while you sleep.

Step 1: Frame Your Income

The idea is to carefully track your income and set up a very hard boundary of how you spend it.

The approach is to frame income into

- Inevitable costs

- Recreation expenses

- Savings

The proportion is to be tuned, but in my opinion, your personal finance may be considered to be more or less healthy if you can keep the proportion at least:

| Inevitable costs | Recreation expenses | Savings |

|---|---|---|

| 50% | 30% | 20% |

I don't use framing between inevitable costs and recreation. I put Savings on the first place as the most essential.

So the whole thing is simplified to a single parameters

- % of income that goes to Savings.

No matter how much you earn. Saving 5-10% of income would be unnoticeable for the whole budget, but it will start to play a huge role in the future.

I don't remember the exact numbers, but it was somewhere around 10-20% when I was starting to pay decent attention to my finances. Eventually, I grew the savings % parameter up to the best F.I.R.E. practices levels.

Step 2: Cut Down Expenses

Cutting down expenses works. It can be done by intentionally increasing the savings ratio parameter.

I can evaluate my average monthly spending baseline as 1X. That's a pretty reasonable number that can be used to calculate an approximate runway.

What I've found out in practice:

- I can easily surge my spending to 2X-3X of the baseline, by not limiting my spending habits.

- In case of a crisis condition, I can cut my expenses down to 0.5X of the baseline almost without a severe drop in quality of life. I can do it by not spending money on things I don't really need.

By tuning the savings ratio parameter, I can easily control my spending to the level I need according to the current conditions.

I believe that the optimal strategy here is to increase the savings ratio parameter gradually until you face a slight feeling of lack of spendables. Then try to increase income in absolute values and repeat.

Step 3: Distribute Cash Flows

I divide all income into cash levels allowing it to go from one level to another like fluid in communicating vessels:

- Level 0 - Undistributed Income

- Level 1 - Spendable

- Level 2 - Crisis Backup

- Level 3 - Early Retirement Assets Portfolio

Level 0 - Undistributed Income

Level 0 is the undistributed amount of income that you have in your pocket while on the way home from the office. Don't spend it!

Level 1 - Spendable

Spendable is all the accessible cash which is liquid as cash in your pocket. As for me, I mainly use debit cards for it but also store something in cash. Level1 is all funds left after applying Savings rules to income.

All amounts that appear to be on Level 1 can be already considered as spent. So there is no sense in evaluating or classifying carefully what's going on here. Amount is also rather low - usually somewhere about 1-2 months of usual 1X expenses. Better if 2X-3X expenses. That's what is considered "cash".

I try to cover all my expenses with Level1: daily expenses, vacations, and gadgets and I never let my hands into Level 2.

Level 2 - Crisis Backup

Level 2 is a crisis backup which is Nonspendable under ordinary circumstances.

If Savings % parameter is chosen optimally, Level2 is kept untouched while Level1 is always enough to cover expenses.

Level 2 should absorb all uncertainty in case of suddenly finished projects, layoffs, time on the bench while looking for new job opportunities, etc.

I believe that 6-12 months of backup is really enough to cover almost all possible negative scenarios.

18 months of backup can also include a legendary armor kit for implementing a couple of side projects and then looking for a relocation package to Antarctica for the position of a senior penguin developer.

Level2 must be still accessible but it doesn't need to be as liquid as pocket money. A bank account with a tiny interest rate and without any time limitations on withdrawals is pretty suitable.

Level 3 - Early Retirement Assets Portfolio

When Level2 plan is fulfilled you don't need to save cash anymore. That's the place where long-term planning strategy comes in the game. Liquidity may be low because the timespan is at least more than 3 years.

As for me, I'm trying to think as widely as possible, applying a 10-year planning interval for Level 3 when considering liquidity, profit opportunities, etc.

In fact, Level 3 is more complicated than just investments and profits. It's also about your whole life planning in a broad sense, like choosing a place to live, where to grow up or not to grow up kids, etc.

But if it cuts down to just investments it's also an interesting thing to research and think about. In fact, there are not so many available options:

- Long term deposits

- Real estate

- Financial markets, including Crypto

Obviously, deposits are the most simple and accessible with the lowest interest rates. Real estate may seem the most obvious and the best solution with a high entry level due to the capital required.

Financial markets are more complicated but they offer higher returns for additional risks.

Cash Flows Management

From the Level 0, income is distributed according to the Savings % rule:

- Part of the income flow goes to Level2, the rest of it goes to Level1.

- If Level2 plan is fulfilled, the savings flow goes to Level3

As I've mentioned, in my opinion, the best strategy is to choose some basic Savings % parameter to start with and then try to increase it gradually.

It can be considered to be chosen optimally if expenses are covered tightly and the Level1 amount does not grow too much. When Level2 is fulfilled all the savings are targeted to Level3.

Simple and efficient.

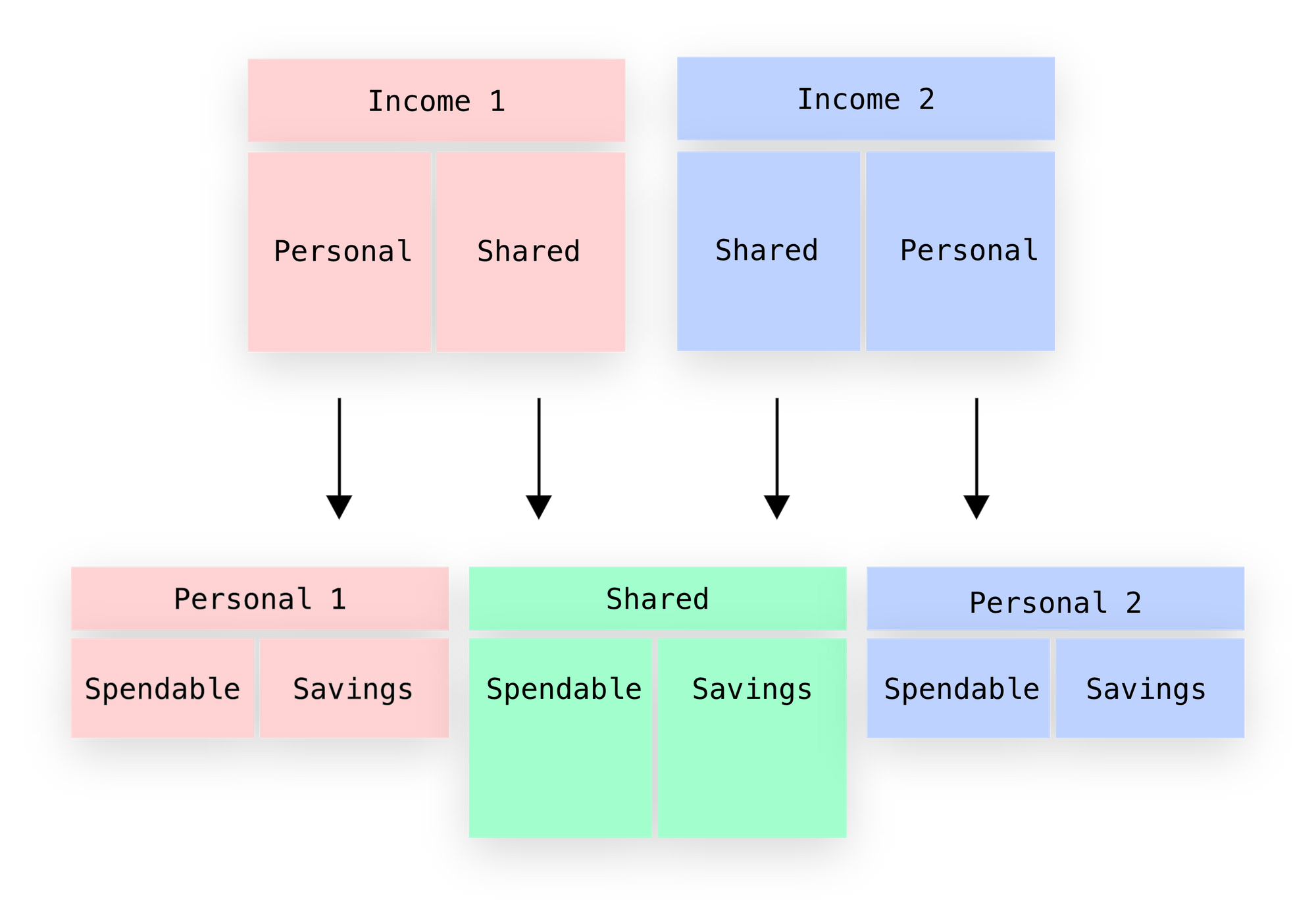

Step 4: Family Finance

It's pretty simple to scale the approach to a family scope. The only thing to be added is one more parameter that will separate shared family income from personal incomes of each member.

Probably some people would prefer to have zero-personal and entire-family. But in my opinion it's more antifragile to separate these two things in some proportion.

Step 5: Financial Independence and Early Retirement

According to the best FIRE practices, 25 annual expenses are needed for complete financial independence for the rest of your life.

Somebody has calculated that this amount, invested in stocks + bonds index funds, will be enough for living assuming, that only 4% of such a portfolio will be spent every year after retirement.

That's quiet a lot, and I think that the majority of FIRE-inspired youngsters won't achieve it at least by the age of early 40s.

There are also many possible ruin risks, like a global financial crisis that may suddenly wipe out a significant part of the portfolio.

Anyway, that doesn't mean that this is a bad idea. Managing personal finance wisely is a GREAT idea and FIRE can be considered as a nice goal or an ideal case.

No doubt that it's still pretty good to be at least 50% financially independent while going on with your favorite daily job on a part-time basis, for example. Any better than 100% dependent.

Comments