iOS Developer, Data Scientist, Quantitative Researcher. What Happened to Me Before June 2017

Before we start the new season of blogging story, let’s dive into the previous season a little bit.

My original blog with the first season can be found in Livejournal it's written in Russian and I’m sure it’s full of broken links. The second one, which is a WordPress mirror is lying here and is surely full of broken links as well.

It has more than 800 posts and represents a period of almost 7 years of my life. I started writing it when I was 19 years old and definitely wrote loads of stupid things there. But anyway, history is history.

To make the long story short…

I’ve always been interested in financial markets. At first, it was just on the level of watching the RBC TV channel (the Russian version of Bloomberg). Then it drifted to the side of automation, quantitative research, and algorithms.

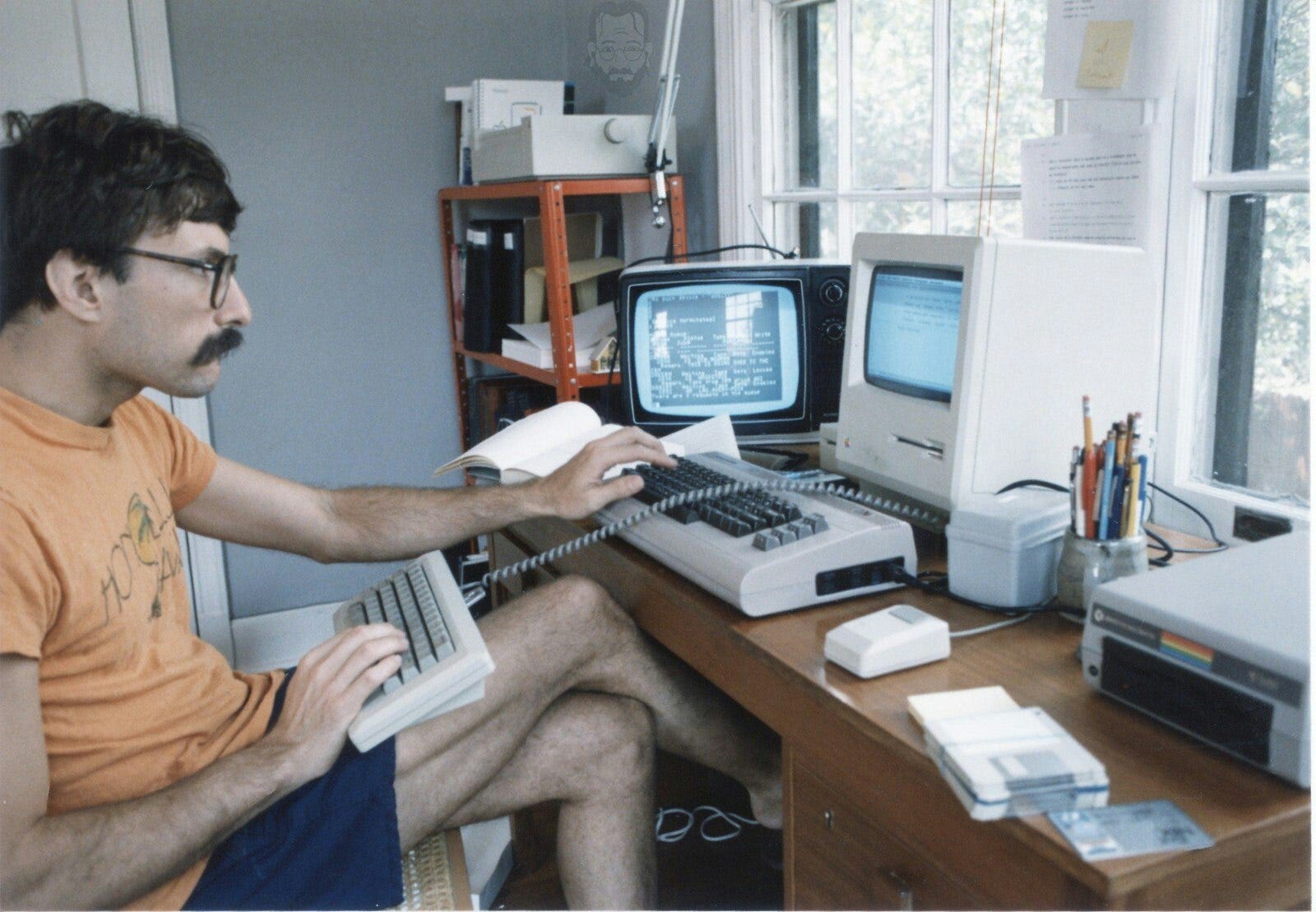

Mainly, I got my first programming skills developing different kinds of things concerning automation of trading when I was a student (Faculty of applied mathematics and programming)

Firstly, I used scripting languages of different black box trading platforms, then I turned to C# and obtained total creator's freedom. After some time, I had a solid understanding of OOP concepts, working with DBs and using different APIs while many other students didn’t.

In 2013, while still being a master's degree CS student I suddenly became an iOS developer, already having my own project in the algorithmic trading field.

I graduated in 2014 with an iOS app as my master’s work.

My own algorithmic trading project wasn’t related to iOS development at all. It was an embodiment of the most common dream of financial market participants: create a solid infrastructure containing quantitative investment models, then make money both for investors and yourself.

I cannot say that the rapidly taking off mobile industry hasn’t seized my attention. It was interesting for me, but my own project, which periodically had a meaningful success, distracted my focus from iOS development from time to time.

I miss a lot of details about mobile development mostly because we were not doing something revolutionary and special in the mobile world. Does anybody do it? Though it was an almost 2,5 years story. We were an own-product development mobile department of a larger SaaS company and had several apps that we developed and maintained.

In the middle of 2015, I paid attention to the new IT hype that was coming from the direction of data science (big data, machine learning, and other buzzwords) and decided not to miss an opportunity to start with data analysis in a very promising startup company. I quit mobile development for data science.

By the way, there were several more reasons for it, including nasty Objective-C, wicked XCode that was annoyingly crashing on Swift projects, and other nasty things that were taking place in the management of our mobile department.

Not having a concrete scope of responsibilities usually means doing everything. In my new place, our data team (of 2 members) was doing everything concerning data: data engineering, data science, data analysis, data anything.

It was time when I significantly improved my skills in deploying heaps of different things and using python with a data science stack. Thankfully, I managed to apply a lot of it in my own project that was still alive and well-performing. In fact, my project at this stage completely consisted of data science.

By the end of 2015, I decided to leave this startup and work on my project full time.

(At the same period of time I also made an attempt to reinforce my position by starting an offline micro-retail-business with my friend but it’s another funny story)

By the middle of 2016, it was clear that my project was turning the way of stagnation. And it coincided with an opportunity to join a high-frequency algorithmic trading company. In fact, they were doing very similar things as I did in my project. The difference was in speed and the market: my algorithms were doing long-term operations on US stock exchanges: NYSE, NASDAQ, AMEX, and their company was doing HFT on Moscow Exchange (MOEX).

I’ve dreamed of working in an algorithmic quantitative investment company since my first years in university and was happy to join them.

Definitely, I will write a separate post about work in the field of financial markets and algorithmic trading someday.

I closed my project at the beginning of 2017 due to extremely poor effort-result balance, poor risk-reward performance compared to buy-and-hold strategies, and a complete lack of future in the world of constantly growing concurrency inside the big money industry. The HFT company also faced financial difficulties and we broke up in the spring of 2017.

At this point, when I’ve completely finished with financial markets I had entire freedom of choice but not too many options.

And that’s where the next season of blogging is coming.

Comments