Will US Companies Hire Fewer Engineers Due to Section 174?

#Freelance, #Taxes

What's going on:

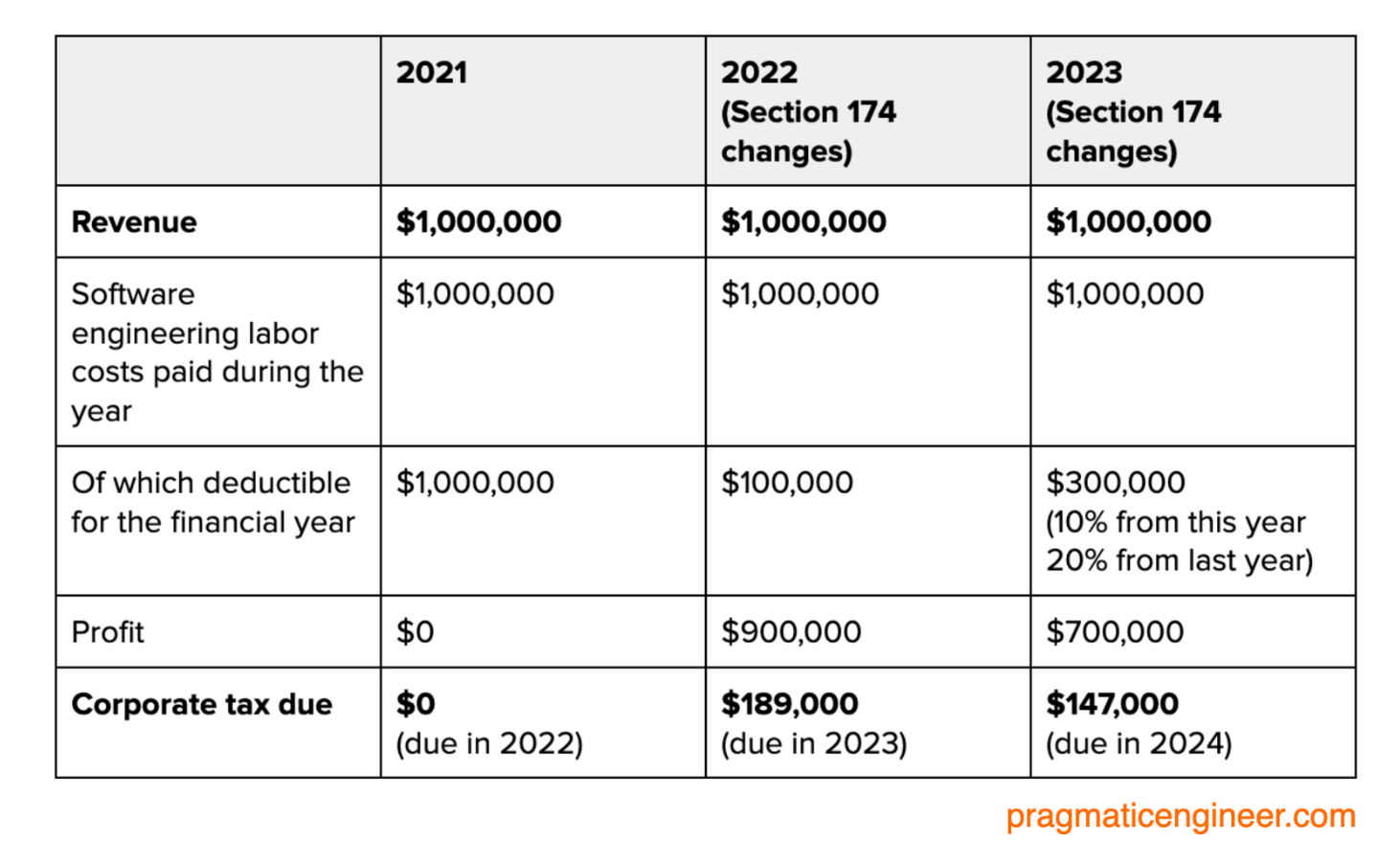

- Previously, companies could offset income by development costs.

- With Section 174 which was introduced by [[Donald Trump]] in 2017, came into force at the end of 2022 it's not possible anymore.

- Now companies can only amortize R&D costs over 5 years and 15 years for offshore R&D.

- It affected tax bills starting from 2023.

- That means that they have a peak tax load in 2023 and this will smooth out for the next 5 years.

Consequences?

It affects both small and large companies that do not have sufficient free-floating cash and those operating very close to breakeven.

It forces companies to move their intellectual property and development from the US to more favorable jurisdictions: Google + Switzerland is a good example.

References

The Pulse: Will US companies hire fewer engineers due to Section 174? - The Pragmatic Engineer

Comments